Titanium dioxide (TiO₂) is one of the most important white pigments in the world, widely used in coatings, plastics, paper, and construction materials. With its high brightness, excellent covering power, and stability, it plays a crucial role in both industrial and consumer products.

Today, as the pigment industry faces stricter environmental regulations and higher performance requirements, a long-standing question resurfaces: Between the sulfuric acid process and the chloride process for producing titanium dioxide, which has the greater competitive advantage for the future?

The Two Main Production Routes for Titanium Dioxide

The global titanium dioxide industry primarily relies on two production methods: the sulfuric acid process (sulfate process)1 and the chloride process.

-

Sulfuric Acid Process:

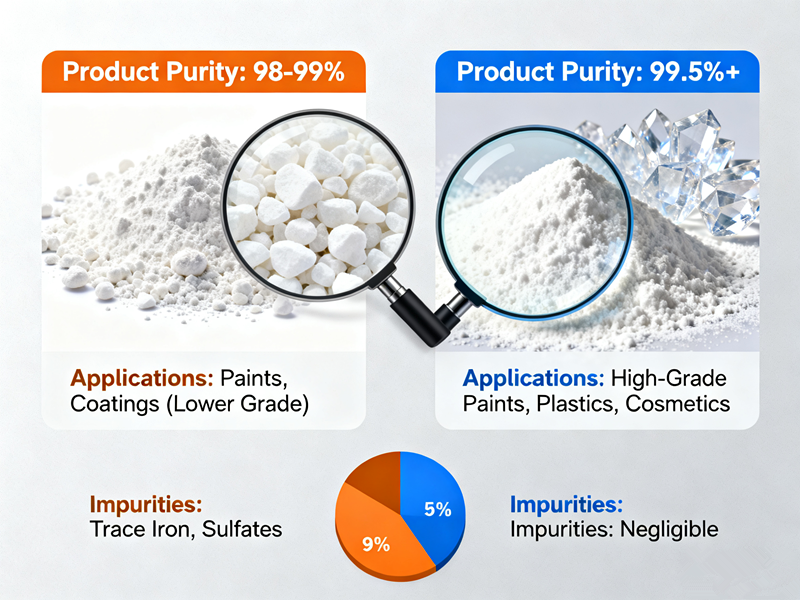

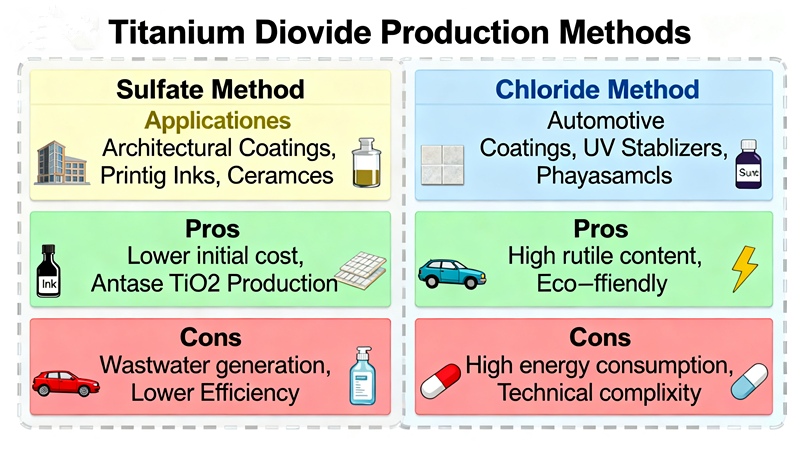

This traditional method uses ilmenite (FeTiO₃) as the raw material. Through reaction with concentrated sulfuric acid, titanium is converted into titanyl sulfate, which is then hydrolyzed, calcined, and milled into finished TiO₂ powder.The sulfate process is known for its mature technology2, low raw material requirements, and strong adaptability, as it can use ilmenite with lower titanium content. However, it also generates large amounts of waste acid and solid waste, requiring complex waste treatment systems.

-

Chloride Process:

This more modern route uses high-grade rutile or synthetic rutile3 as feedstock. In a high-temperature chlorine atmosphere, the titanium reacts to form titanium tetrachloride (TiCl₄), which is then oxidized to produce pure titanium dioxide.The chloride process is known for high product purity, continuous operation, and lower environmental impact when supported by advanced equipment. But it demands high-quality raw materials, strict process control, and large capital investment.

Both processes can produce high-performance TiO₂ pigments, yet their economic and environmental performance differ significantly — especially under the global push for green manufacturing.

Environmental Pressure and Technological Transformation

In recent years, environmental sustainability has become a key driver of industrial transformation. Governments worldwide are implementing stricter regulations on emissions, waste treatment, and energy efficiency.

Under this backdrop, the chloride process4 is gaining favor due to its relatively cleaner production. It produces minimal liquid waste, and by-products such as chlorine gas can be recycled, forming a closed-loop production system. Western producers like Chemours, Tronox, and Lomon Billions have invested heavily in chloride technology, reflecting this trend.

In contrast, the sulfuric acid process5 faces growing environmental pressure. The disposal of waste acid and iron residues remains a major challenge. Although modern plants have improved recovery systems for acid and ferrous sulfate, meeting future carbon reduction goals will require further innovation.

Nevertheless, technology upgrades are changing the landscape. Some Chinese and Indian manufacturers have successfully developed energy-efficient sulfuric acid routes that recycle waste acid and recover by-products, dramatically improving sustainability. This shows that the sulfate process still has room for advancement, especially in regions with large-scale existing capacity.

Cost Efficiency and Market Flexibility

When it comes to production cost, the picture is more complex.

The sulfuric acid process has lower capital investment and flexible raw material options, making it attractive in emerging markets where ilmenite is abundant and labor costs are moderate. It remains the dominant process in Asia, particularly in China, which accounts for over 60% of global TiO₂ output.

The chloride process, on the other hand, offers higher efficiency and lower energy consumption per ton once established. However, it requires high-purity raw materials such as rutile or upgraded ilmenite, which are more expensive and geographically limited. For many regions, the availability of such feedstocks determines whether the chloride route is economically feasible.

From a market adaptability perspective, the sulfate process has a clear edge. It can switch between ilmenite sources and produce various grades of pigment to meet diverse market demands — from general-purpose coatings to construction applications. The chloride process is more specialized and typically focuses on high-end coatings and plastics requiring superior whiteness and durability.

Product Quality and Application Performance

In terms of pigment performance, the chloride process generally produces whiter, purer, and more consistent titanium dioxide6, with excellent dispersibility and weather resistance. This makes it the preferred choice for automotive paints, aerospace coatings, and high-end plastics.

The sulfuric acid process, while slightly behind in brightness and stability, can still achieve high performance with modern surface treatment technologies. For many applications — such as construction materials, paper, inks, and general paints — the difference in performance is minimal.

Furthermore, continuous improvements in post-treatment and particle control have allowed leading sulfate-process producers to narrow the gap. Today, many sulfate TiO₂ grades can meet the same standards as chloride products in most industrial uses.

The Future Competitive Landscape

Looking ahead, both processes will continue to coexist, serving different segments of the global market.

- The chloride process will likely dominate high-end and export-oriented production, especially in regions with advanced technology and environmental infrastructure.

- The sulfuric acid process will maintain strong competitiveness in cost-sensitive and rapidly growing markets, where flexibility, scalability, and local resource utilization are key.

However, the future competitive advantage will not depend solely on the process type, but on how efficiently and sustainably each process is managed.

Innovations such as:

- Closed-loop recycling systems for acid and chlorine,

- Energy recovery from exothermic reactions,

- Digital monitoring for process optimization,

- And hybrid production lines combining both processes,

…will shape the next generation of titanium dioxide manufacturing.

Conclusion: A Dual-Path Future for Titanium Dioxide

The competition between the sulfuric acid and chloride processes is not a zero-sum game. Instead, it represents two complementary pathways toward a more sustainable pigment industry.

The chloride process embodies technological modernization and aligns with global sustainability goals, while the sulfuric acid process represents industrial adaptability and cost efficiency in resource-rich regions.

As environmental technologies mature and the global market diversifies, the future of titanium dioxide production will likely be hybrid — cleaner, smarter, and more efficient. Both processes, refined and reimagined, will continue to drive the pigment industry forward.

Whichever path a producer takes, the real competitive advantage lies in balancing quality, cost, and sustainability — the three pillars of the future titanium dioxide industry.

At XT Pigment, we believe that understanding these differences helps every pigment dealer, manufacturer, and construction material producer make smarter business decisions.

👉 Contact us today to learn more about high-quality titanium dioxide solutions and find the right grade for your market needs.

XT Pigment — your trusted partner in pigment innovation.

-

Explore this link to understand the traditional method of titanium dioxide production and its environmental impacts. ↩

-

Learn about mature technology to see how established methods influence production efficiency and sustainability. ↩

-

Explore this link to understand how high-grade rutile enhances titanium production efficiency and quality. ↩

-

Understanding the chloride process can provide insights into cleaner production methods and their benefits for sustainability. ↩

-

Explore this link to understand the environmental challenges and innovations in the sulfuric acid process. ↩

-

Exploring the uses of titanium dioxide will reveal its significance in automotive, aerospace, and plastics industries. ↩